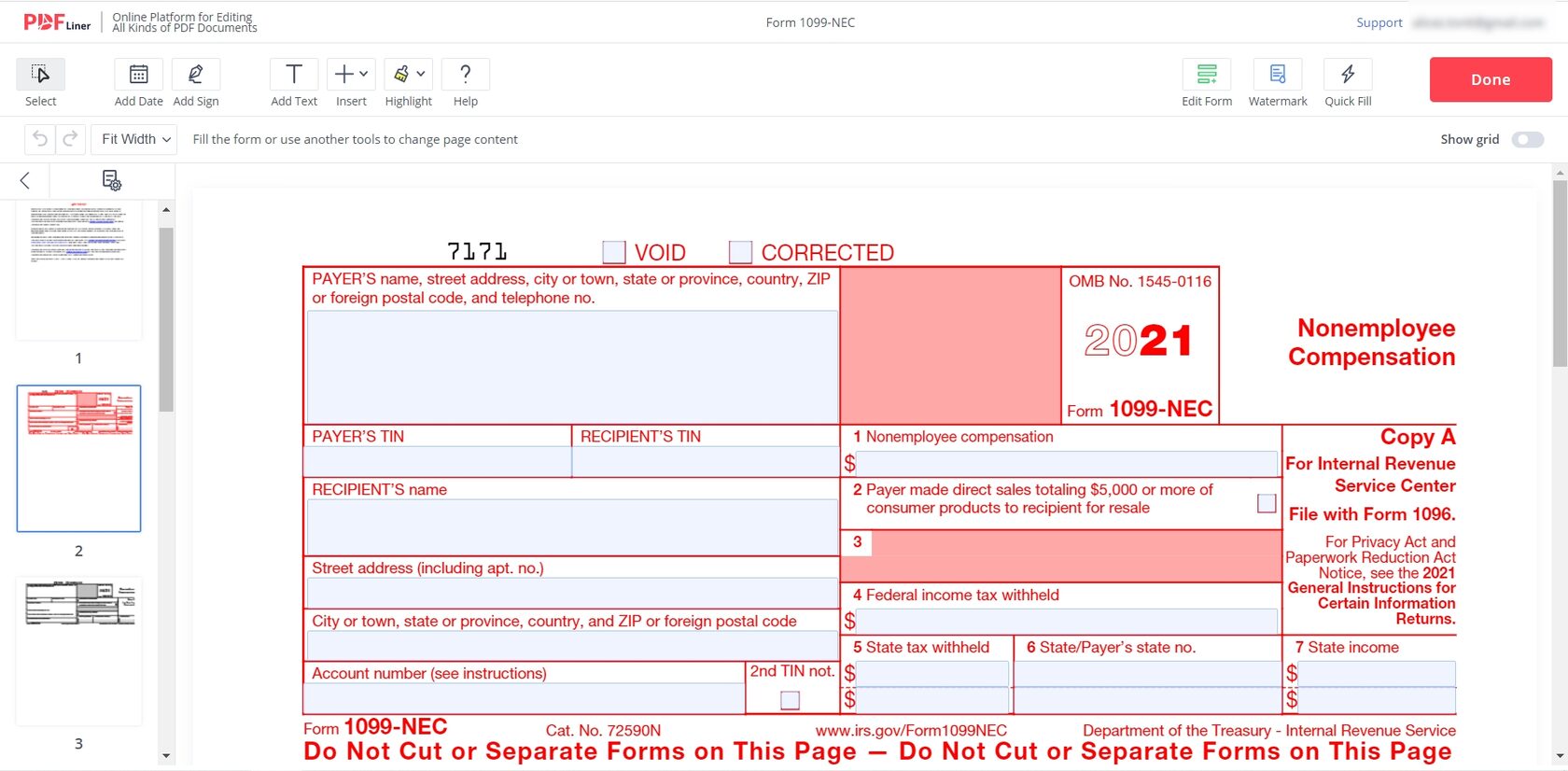

You may also have a filing requirement Common Use Of 1099 NEC Form One common use of a federal tax 1099NEC form used to report payments by a business to US resident independent contractors For form 1099NEC, business includes nonprofits and other organizations The recipient must not be an employee (so the recipient must be a contract worker)1099 Tax Form Independent Contractor Universal Network Print this templates The IRS has made significant changes to the 1099MISC form by revising the 1099NEC form The new 1099NEC is utilized to report nonemployee payment (NEC) beginning with the tax year of

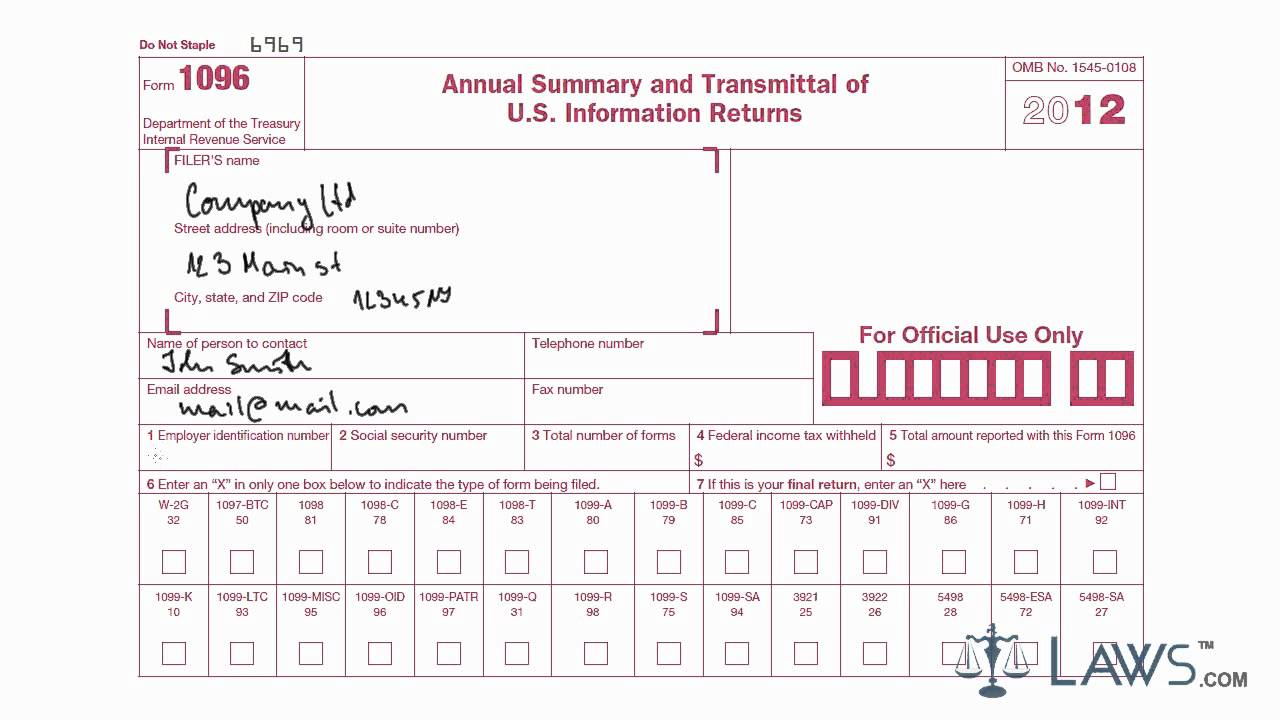

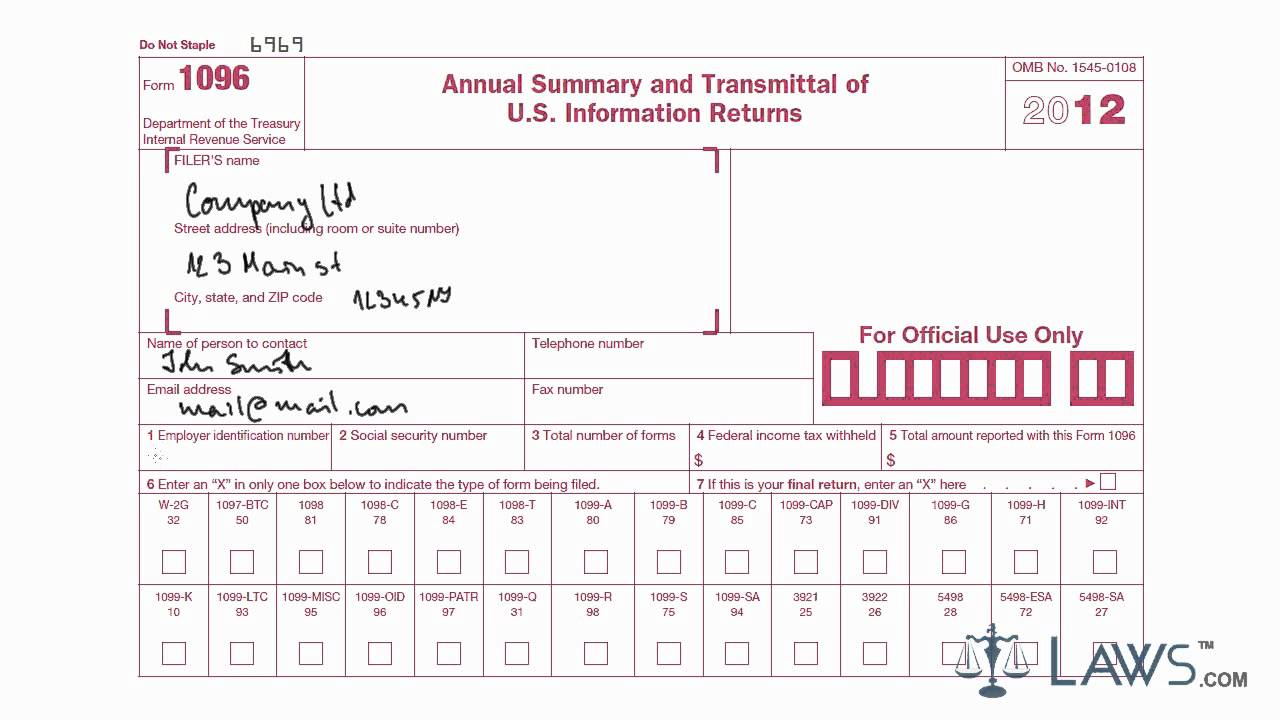

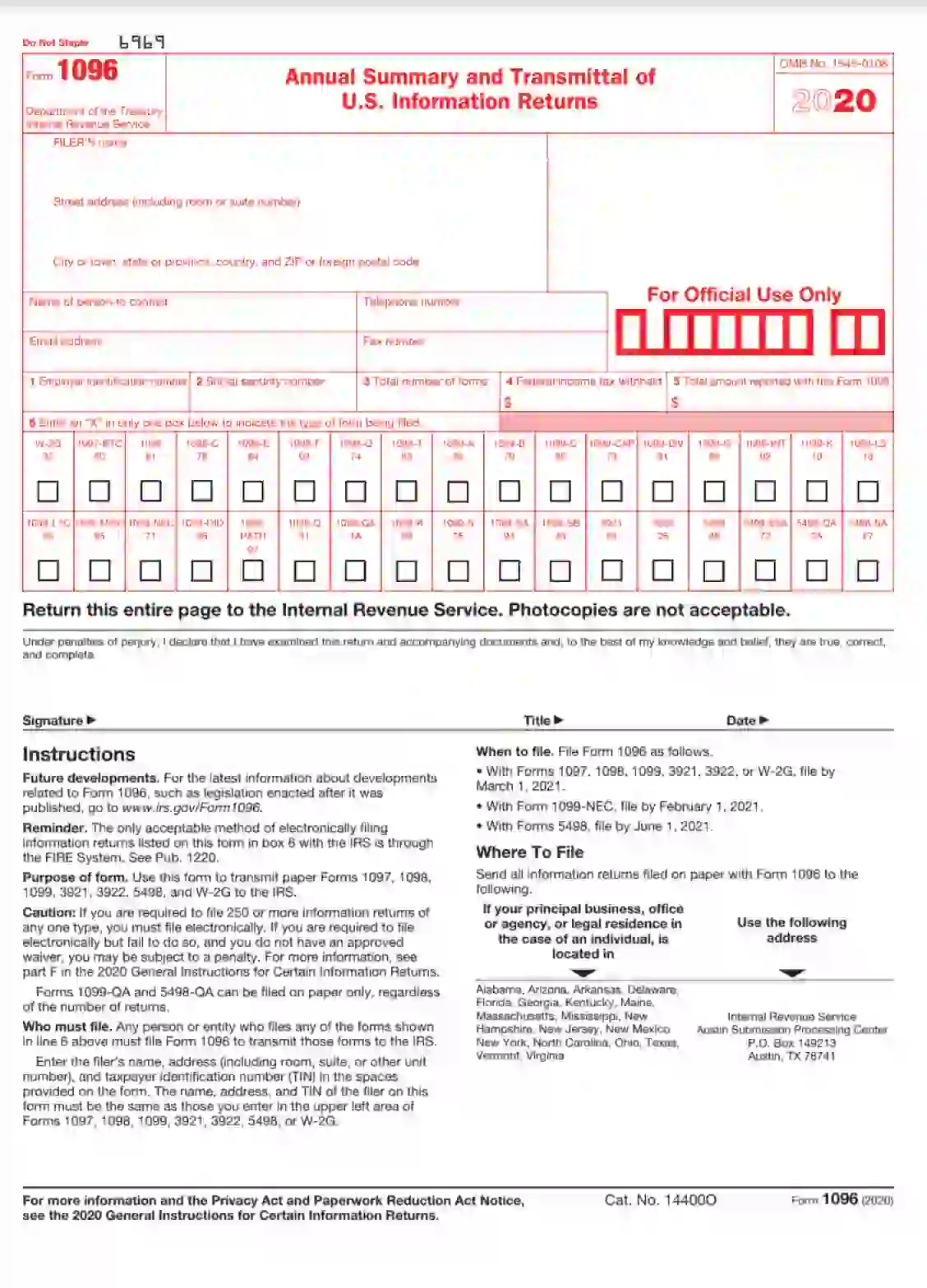

Learn How To Fill The Form 1096 Annual Summary And Transmittal Of U S Information Return Youtube

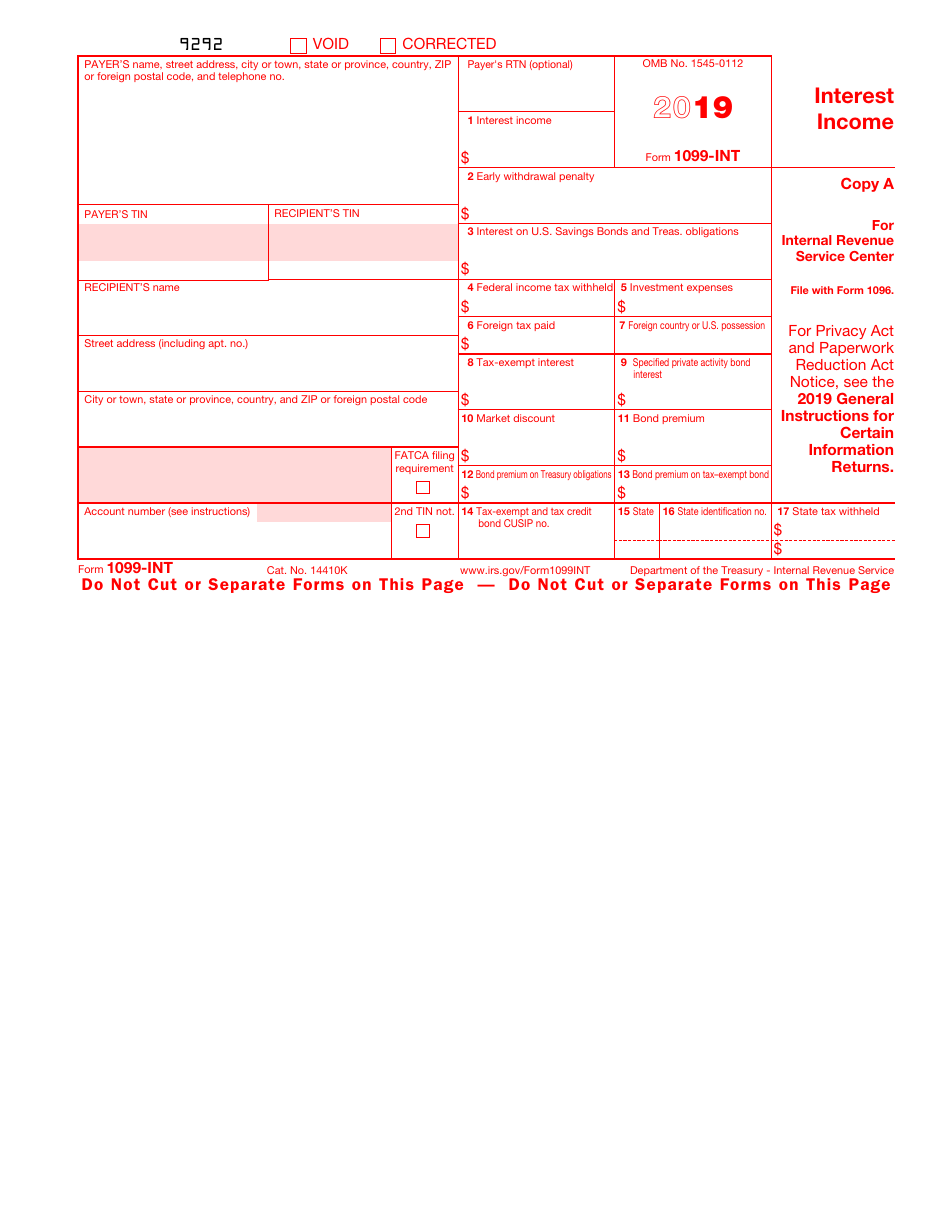

Can i print my own 1099 forms

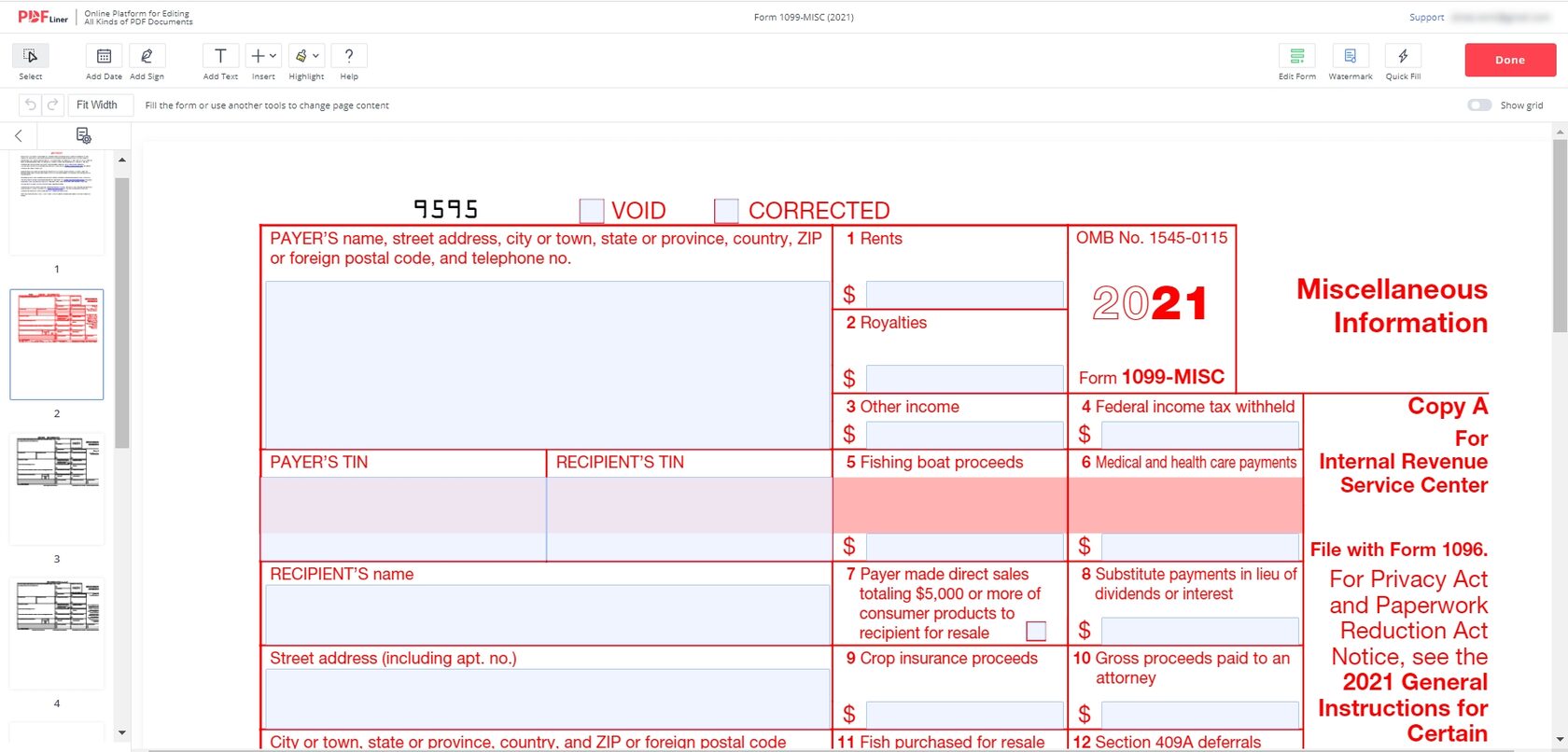

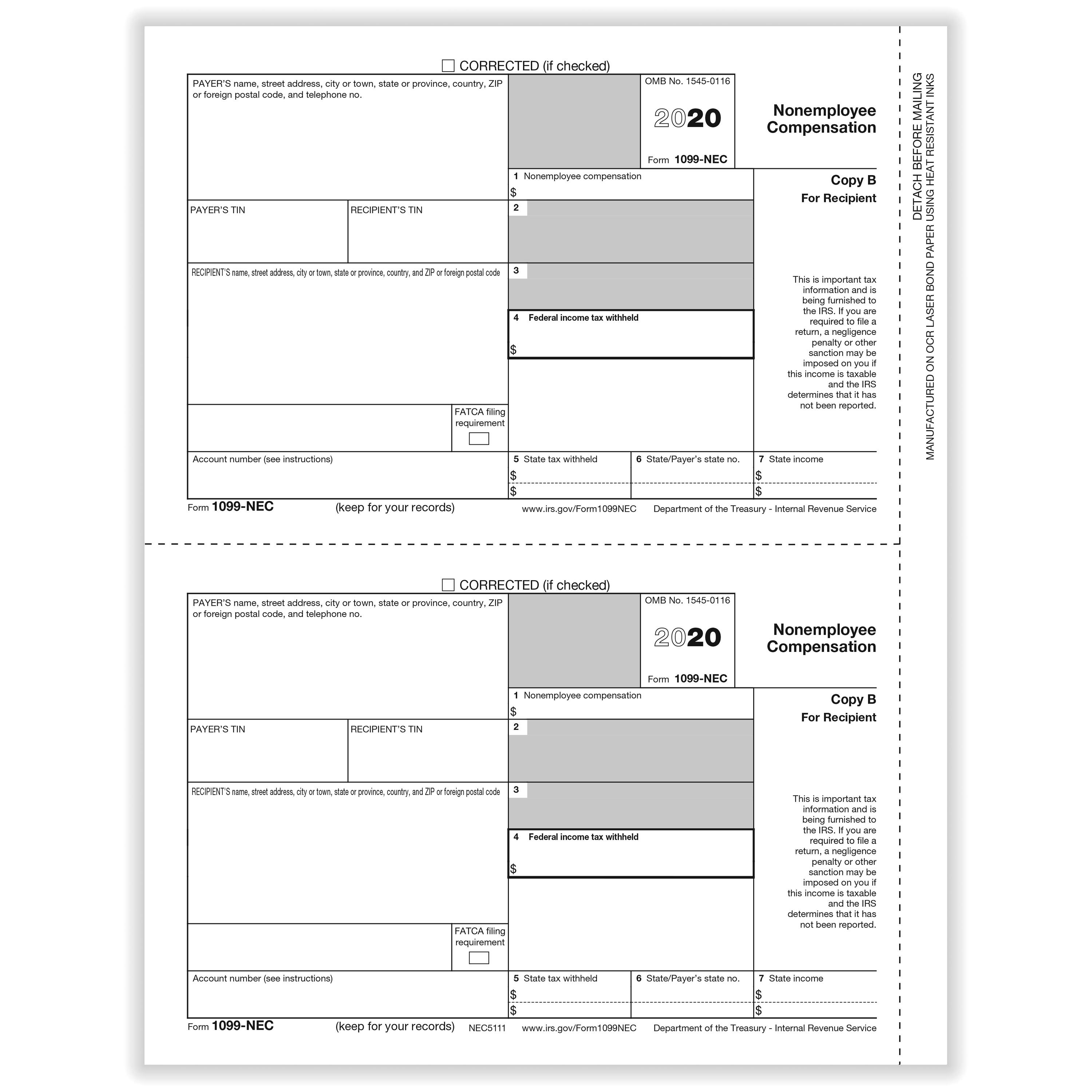

Can i print my own 1099 forms- 1099 MISC Form for an Independent Contractor File 1099 Misc Form Online with easy steps Quickly File Form 1099 Online and Send it to IRS & RecipientPrintable 1099 Form 21 Copy B – The 1099 form is used to report certain kinds of income a taxpayer has earned throughout the year The importance of a 1099 is that it's used to track the nonemployment earnings of tax payers A 1099 can be issued for dividends in cash received to buy stock, or to record interest income earned through the bank account

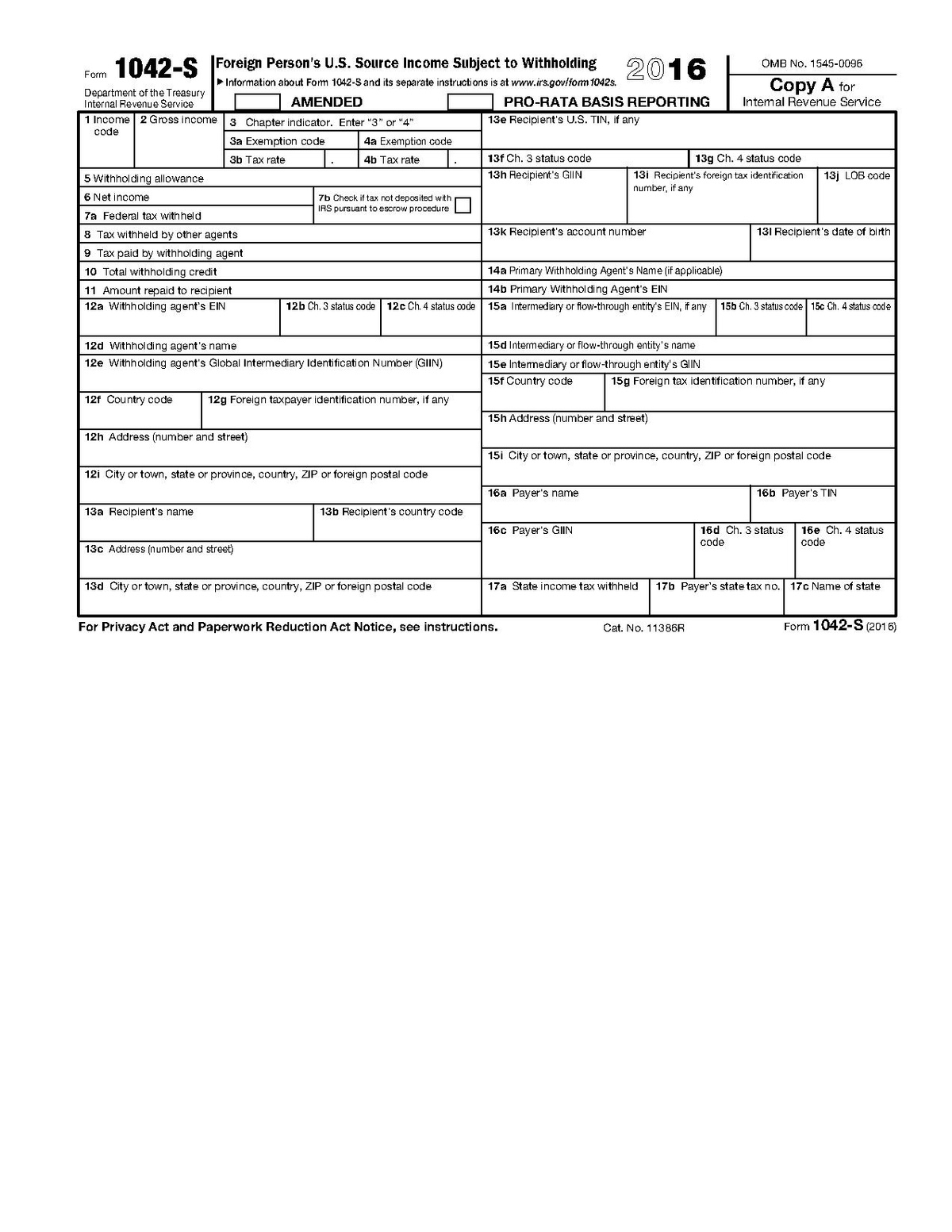

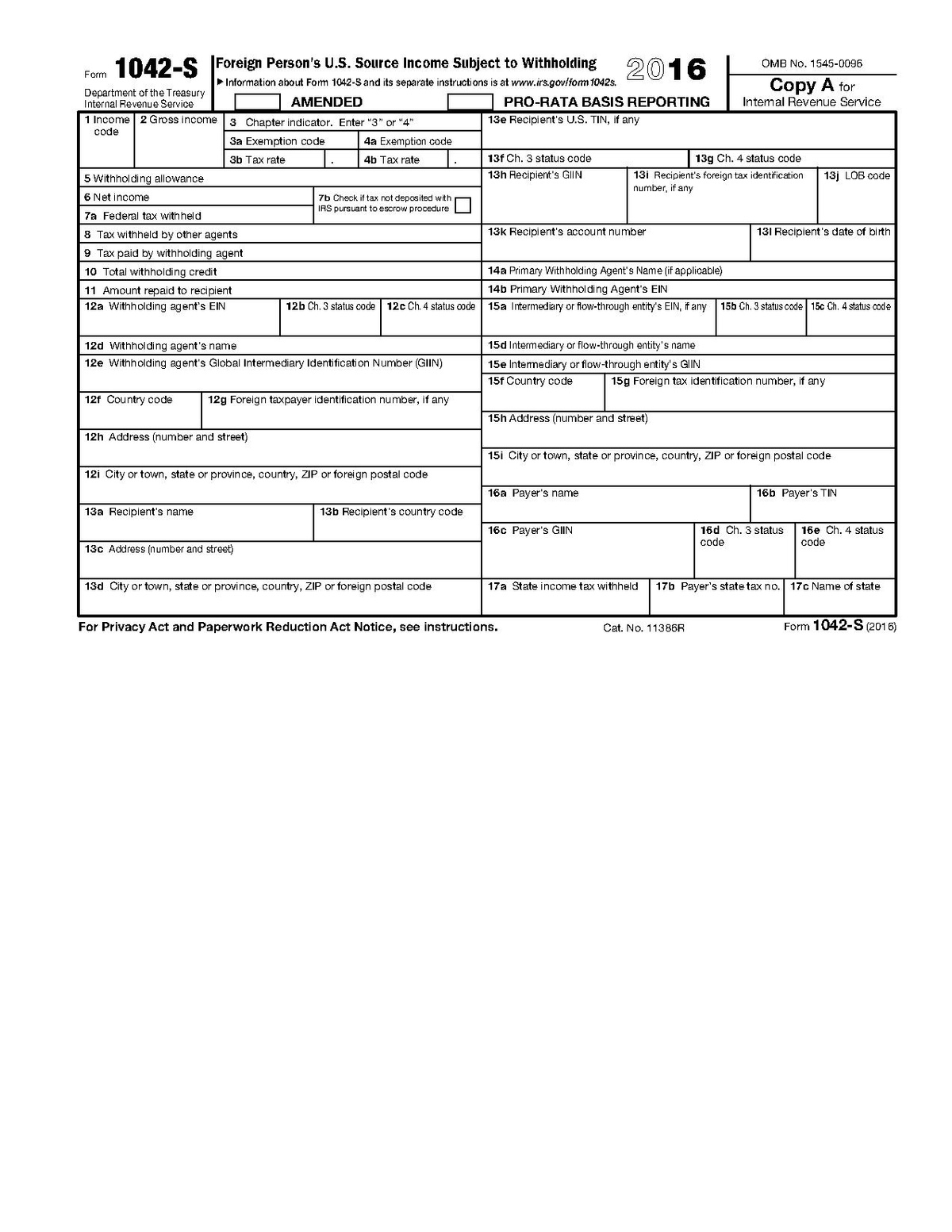

Form 1042 Wikipedia

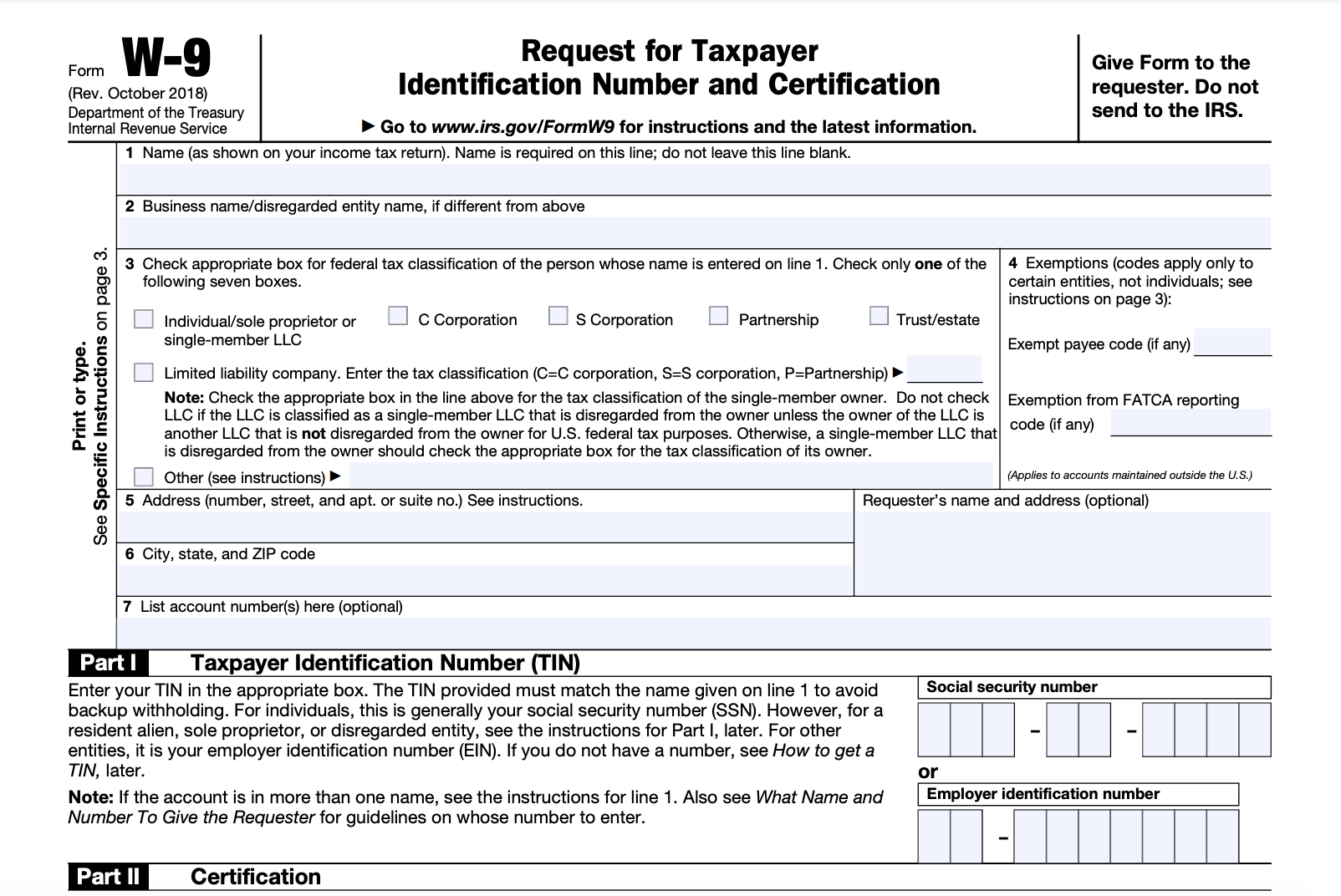

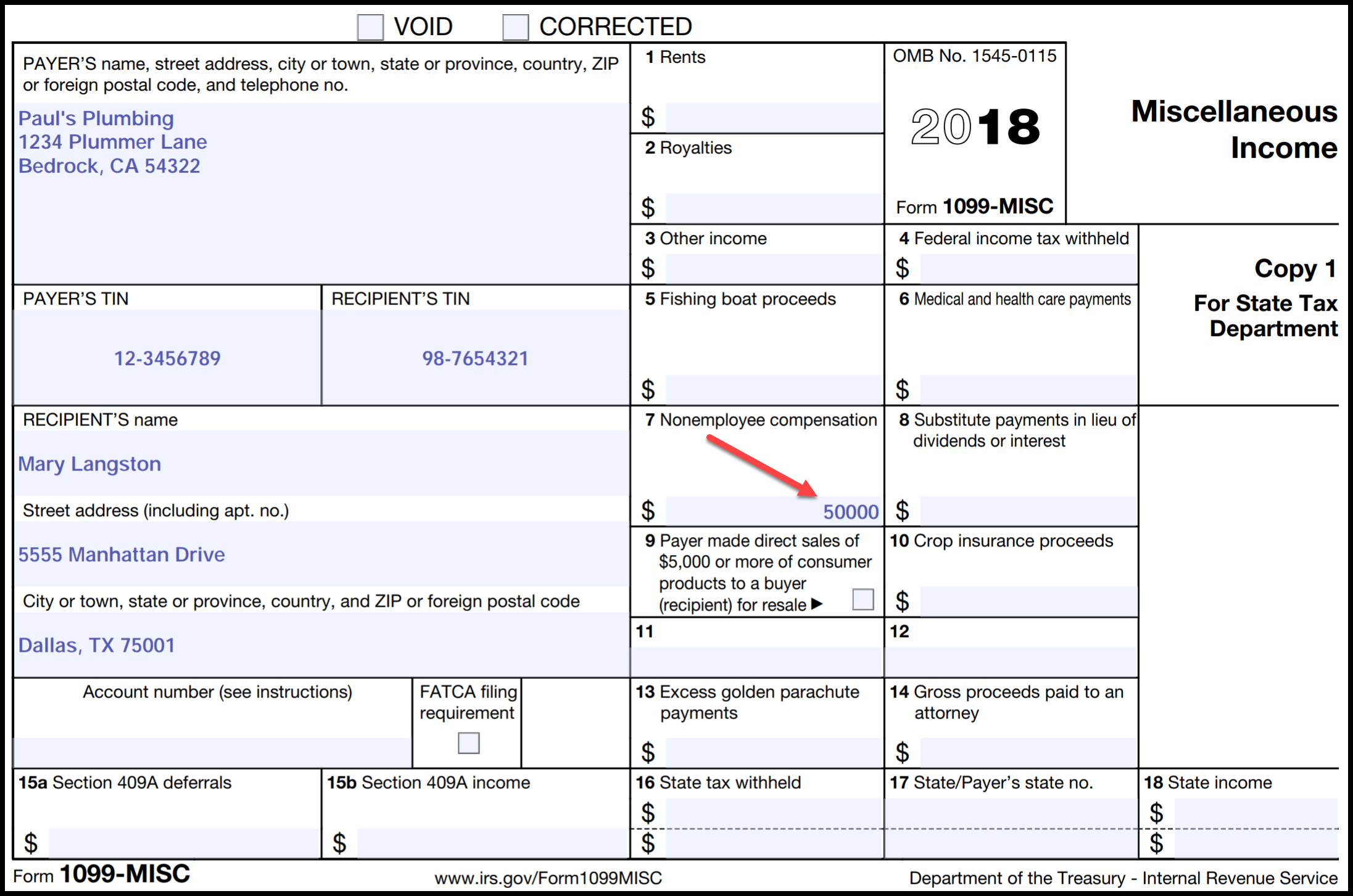

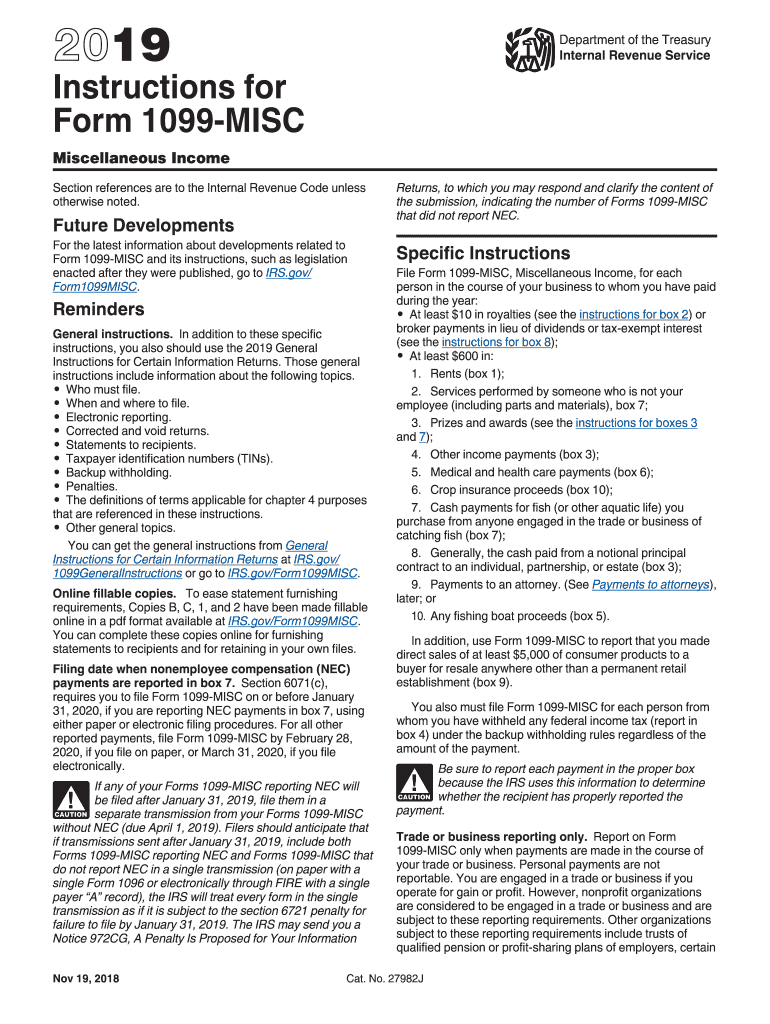

A 1099R form is one of the forms in 1099 These 1099 Tax Forms are used to report several types of income that a person may get, other than salaries, such as independent contractor income Workers operating as independent contractors need to provide their own benefits and cover their expenses For tax purposes, the key thing to understand is the form that you receive If you are paid as an independent contractor, you will receive a Form 1099MISC, while if you are paid as an employee, you will receive a W2 formPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,

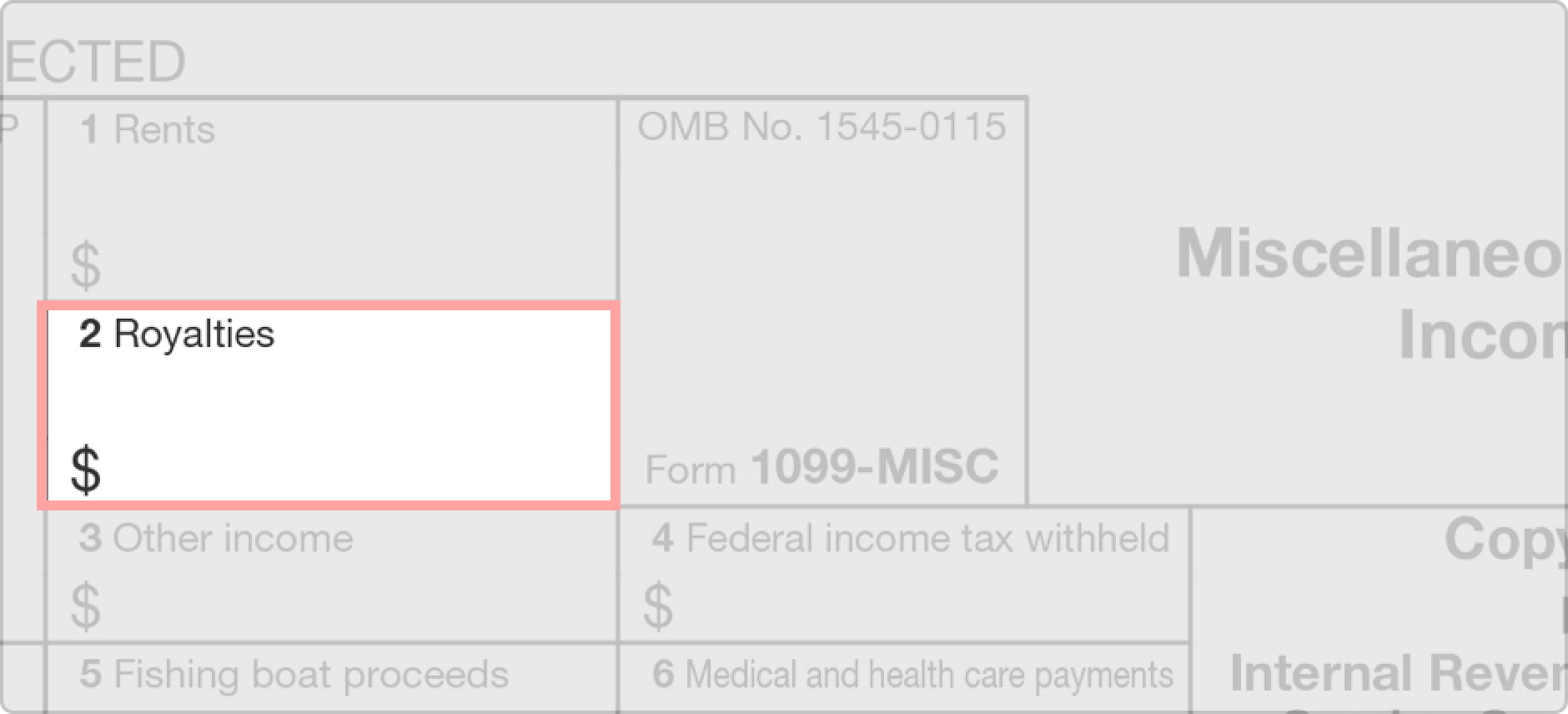

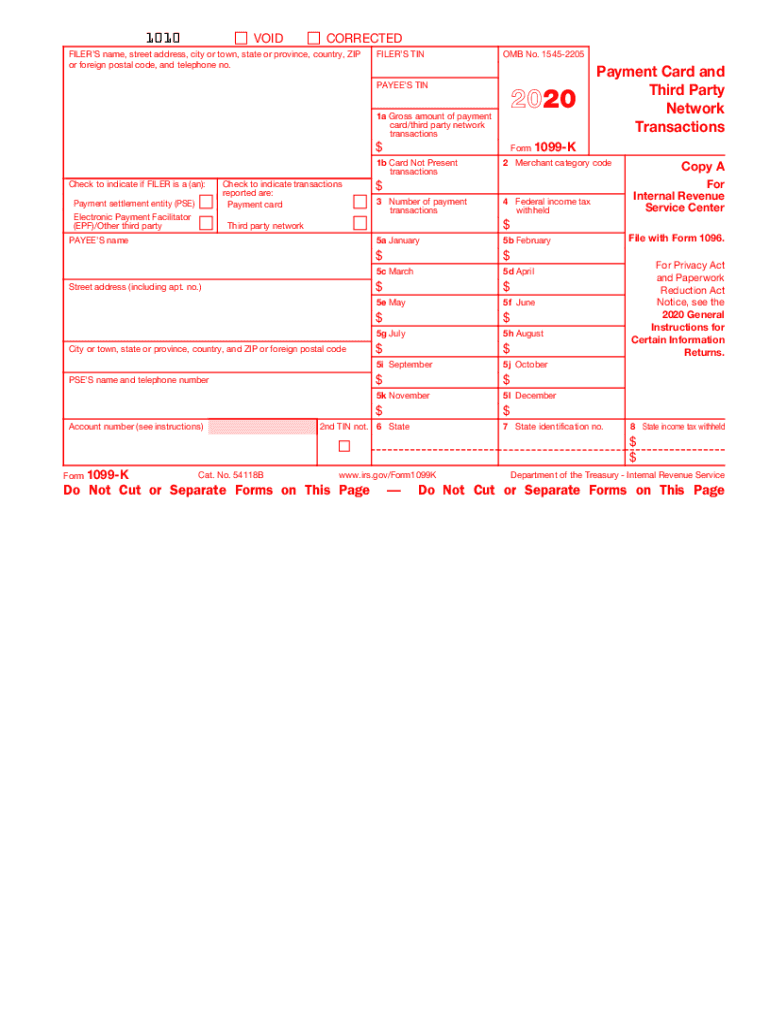

Different 1099 Forms There are several types of 1099 Forms Here are the commonly used 1099 Form for the tax year 1099 MISC IRS 1099 MISC Form reports payments made to independent contractors for rent, royalties, gross proceeds, etc, during the calendar year The payments made during the year must exceed $6009/6/21 IRS provides last minute tips for last minute filers Free tax filing for students Printable 1099 Forms For Independent Contractors Best Printable 4506 T form MODELS FORM IDEAS Fill Free fillable IRS PDF forms Downloadable form W 9 Printable W9 Printable Pages in Irs form 1040 15 Sample 29 Free Federal In E Tax forms Free IRS Fillable Forms 2290 941 941 X W 2 & 109926/1/21 This term includes anyone who does independent or freelance work They receive a Form 1099 Online for the work they have performed on the course of business or trade In the tax year , we can observe most of the workers choosing to become a 1099 worker Independent contractor The independent contractors are 1099 workers and selfemployed

Form 1099 MISC Independent Contractors – Generally, any business that has paid out a minimum of $600 to a person or any unincorporated organization that has received a minimum of two payment quantities from that individual or organization must issue a 1099 Form to every person or company who has received at least one of these payment amounts This form is used by the IRS1099 Form Printable Blank in PDF or Online Fillable Form The tax form 1099 is required by the IRS to be issued to anyone who has received income payments of $600 or more during the tax year The form is used to report income from any sources including, but not limited to, interest, dividends, alimony, royalties, pensions, part of a business sale, life insurance settlement or anyPrintable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms from ipinimgcom Obtain a blank 1099 form (which is printed on special paper) from the irs or an office supply store manage templates from as an independent contractor who did not list his llc on the w9 upon submission, can i report those

1099 R Tax Form Printable 1099 Misc Form 1099 R By Form1099 Issuu

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

23/7/21 IRS 1099 NEC used to report compensation paid to nonemployees, selfemployed individuals, independent contractors etc Previously, these payments were reported on Form 1099 MISC But from tax year, you must report the nonemployee compensation on the new 1099 NEC Tax Form This means, if you made payments to nonemployees like prizes or18/3/21 Form 1099 NEC & Independent Contractors Question What's the difference between a Form W2 and a Form 1099MISC or Form 1099NEC?1099MISC Form Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below A 1099NEC Form is now the appropriate form to

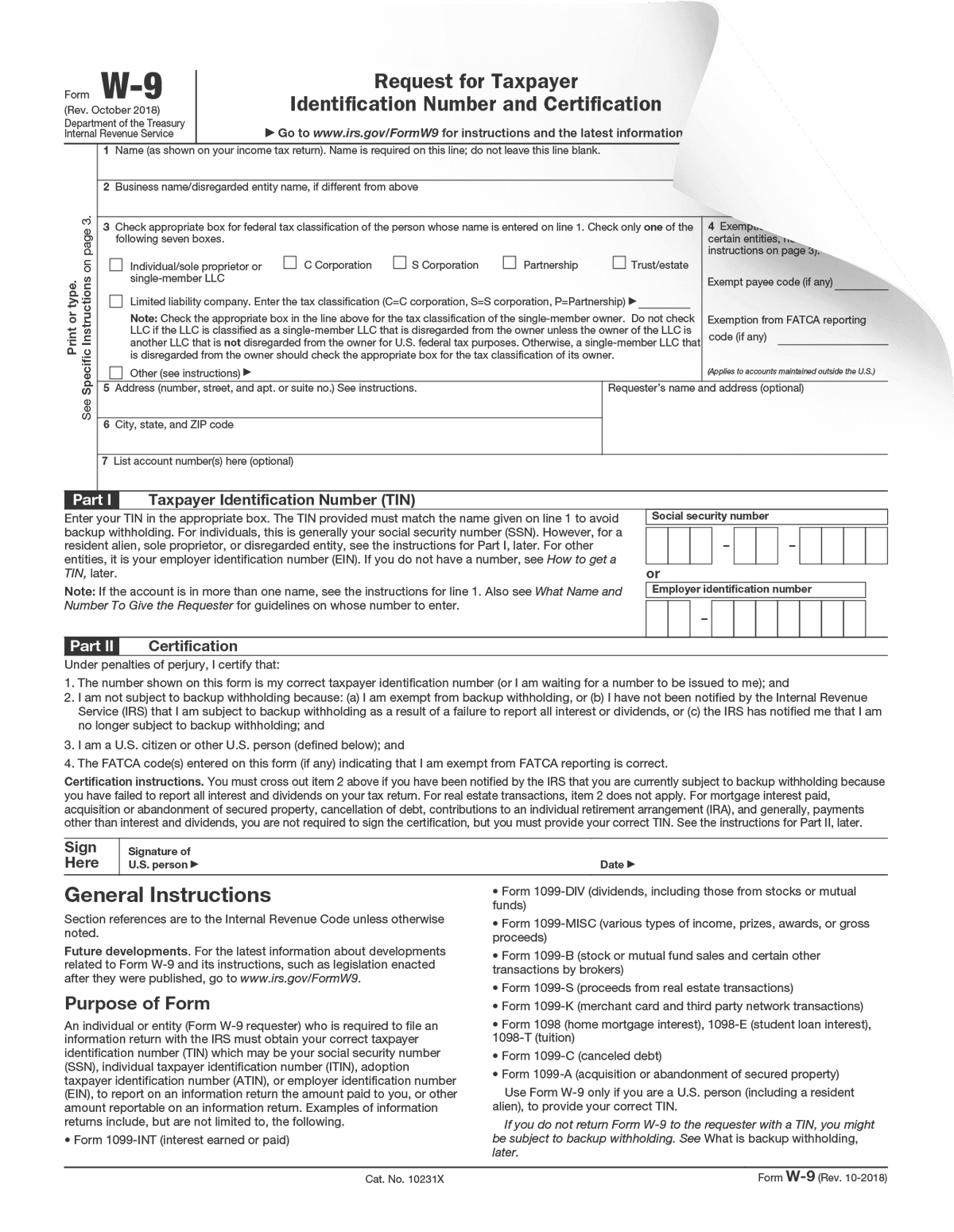

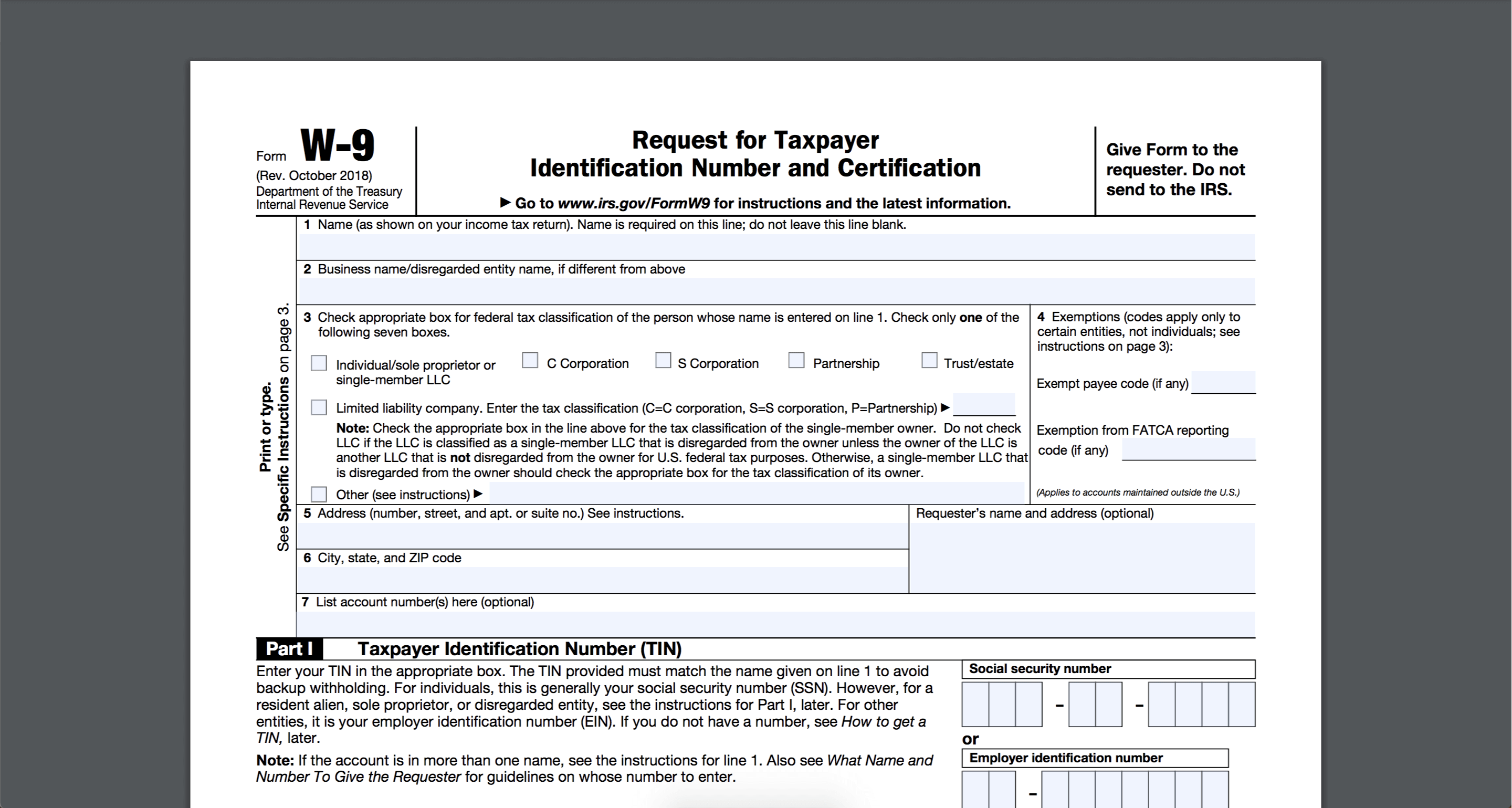

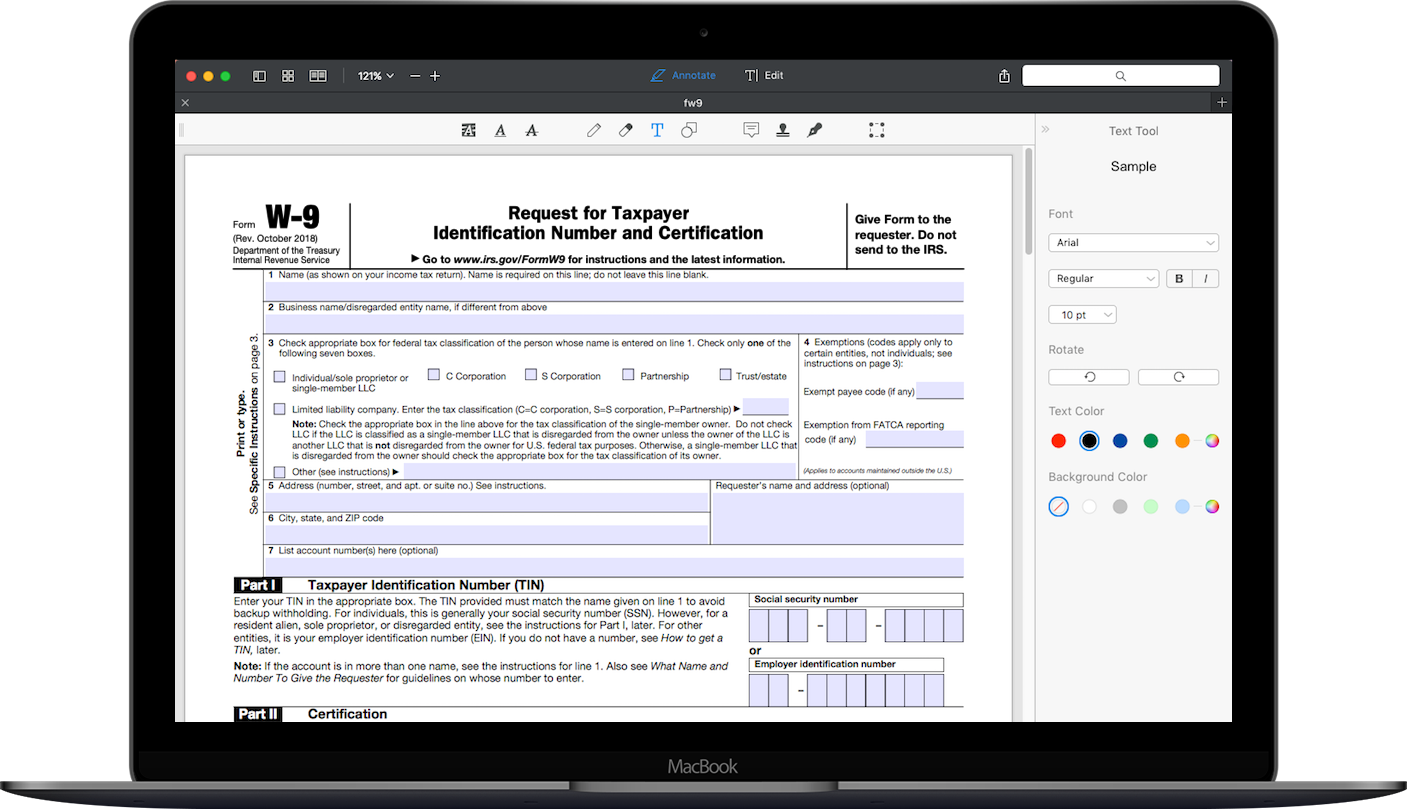

Form W 9 Form Pros

All About Forms 1099 Misc And 1099 K Bookkeeping Business Marketing Bookkeeping Business Business Tax

17/5/21 1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions Complete a contractor set up form for each 1099 contractor $ 13 excess golden parachute payments This means that you can't print apdf version from the internet and use it to file your forms5/1/21 Form 1099 NEC is received by Independent contractors Prior to the tax year, if you were carrying out the business activity through small business and hires an independent contractor The independent contractor is a person who works for business or trade, but not as an employee Form 1099 NEC is received by the independent contractor1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions For more information, see pub Companies use it to report income earned by people who work as independent contractors the irs requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor, so that the irs

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

1099 Tax Form Delaware – The 1099 forms provide certain kinds of earnings earned by a taxpayer during the year The importance of a 1099 is that it's used to record nonemployment income earned by the taxpayer It doesn't matter if it's dividends in cash for owning a stock or interest accrued from a bank account, a 1099 may be issued 1099 Tax Form Delaware15/4/21 1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions This means that you can't print apdf version from the internet and use it to file your forms Fill, sign and send anytime, anywhere, from any device with pdffiller Just insert the required information into the fillable fields1099 Form Independent Contractor – In the event you have carried out any freelance work or other impartial contractor function, you may get a 1099 Form from businesses that you have labored with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid to you previously year

W9 Forms 21 Printable

How To Print 1099 Forms In Quickbooks

The form is used for reporting payments made to independent contractors and others The form is not necessary when the hirer has their own tax identification number When a person is hired for a new job, the employer should fill out a 1099A form The 1099A form is used to report payments made to an independent contractor or other person27/4/21 1099 Form Independent Contractor Pdf 1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free InstructionsFor instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and Online service compatible with anythe 1099 misc form isA list of job recommendations for the search 1099 form independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

/1099-misc-form-non-employee-income-398362_updated_HL-c7c12d946b8f47689f520bc37e4efca8.png)

Form 1099 Misc What Is It

1099 Form Independent Contractor Pdf W 9 Form Print Form Pdf Example Calendar Printable / Individuals should see the instructions for schedule se (form 1040) Form 1099 misc is a tax form used by the irs to track all the miscellaneous income paidPrintable Form 1099C – A 1099 form records certain kinds of income that tax payers have earned during the year It is used to track nonemployment earnings It can be used as cash dividends to purchase stockor earnings from the bank account Printable Form 1099C Irs Gov Form 1099 C Universal NetworkLooking for a printable form 1099MISC and Independent Contractors?

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec Instructions And Tax Reporting Guide

The taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file Form 1099NEC Replaces Form 1099Misc Box 7 As a 1099 filer, you must know updated about 1099 tax formsInternal Revenue Service provides various forms for reporting various types of payments People who use 1099 forms must have an idea about the new formForm 1099 NEC Online Fillable Copies Have you paid an independent contractor in tax year?Then you need to report the nonemployee compensations paid to the independent contractor in 1099 NEC Form 1099 NEC is filed by the tax payers when they pay an independent contractor about $600 annuallyThe payments made with the independent contractor are on

F 1099 Misc

1

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller from wwwpdffillercom For a pdf of form 1099‐misc, go to If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes checkmark checks pdf checksFree download Printable 1099 Forms For Independent Contractors 19 from irs free fillable forms examples with resolution 1045 x 647 pixel Free IRS Fillable Forms 2290 941 941 X W 2 & 1099 Beste Amerikanischer Lebenslauf Ideen Irs 1031 Exchange Form IRS kicks off official start of tax season Fill Free fillable IRS PDF forms Free tax filing for students Fill Free fillable IRS PDFBlank 1099 Form 21 Printable – The forms for 1099 report specific kinds of income earned by taxpayers throughout the calendar year The importance of a 1099 is that it's used to track nonemployment income earned by taxpayers It can be used for cash dividends received to purchase stockor income from an account in a bank Blank 1099 Form 21 Printable

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

1 0 9 9 N E C F O R M S Zonealarm Results

Independent Contractor 1099 MISC Form – In general, any business that has paid at least $600 to some individual or any unincorporated organization which has obtained at least two payment amounts from that person or business should problem a 1099 Form to every person or business that has received a minimum of one of these payment quantities This form is utilized by the IRS18/4/21 1099 Form Independent Contractor Pdf / 1099 Misc Form Fillable Printable Download Free Instructions / Some document may have the forms filled, you have to erase it manually Here's how to fill out form You can import it to your word processing software or simply print it Here's everything you need to know about the processAccurate Printable 1099 NEC Form Online Filing for Freelancers are not considered as employees, instead they are independent contractors You paid him/her $700 as nonemployee compensation When you're correcting printable 1099 NEC Form,

Generate 1099 Misc Form 1099 Tax Form Printable 1099 Form

Digitalasset Intuit Com Document 4724mxi Turbotax Taxprepchecklist Pdf

Here you will find the fillable and editable blank in PDF Create your sample, print, save or send in a few clicks No software required Online service compatible with any PC or mobile OS1099 MISC Form helps selfemployed people or independent contractors to declare their annual earnings to the IRS Even if you're an independent contractor, you're still liable for Social Security & Medicare taxes that are calculated on Schedule SE & attached to your tax return documents Benefits of receiving a 1099 MISC FormAnswer Although these forms are called information returns, they serve different functions Employers use Form

Fillable Irs 1099 R Form For Tax Year Form 1099 Online By Form1099 Issuu

16 Printable 1099 Tax Form Awesome Independent Contractor Tax Forms Canada Form Emmawatsonportugal Models Form Ideas

18/6/21 The 1099 form is meant for freelancers and independent contractors Therefore, the individual needs an employee vs The 1099 form is an important form for independent contractors In a simple context, you must file 1099 misc if you have paid any independent contractor a sum of $600 or more in a year For more information, see pubForm 1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTED9/1/21 Printable 1099 NEC Tax Form Overview In this tax session millions of independent workers will receive 1099 NEC Tax Form in the mail for the first time 1099 NEC Tax Form is the new Form to report nonemployee compensation that includes payments made for independent contractor jobs, freelancers, etc

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

F O R M 1 0 9 9 P R I N T A B L E 2 0 2 0 Zonealarm Results

1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions Approve documents by using a lawful electronic signature and share them via email, fax or print them out You must report to the employment development department Why do i need to file a 1099 form?19 1099 Form Independent Contractor – A 1099 Form is really a form of doc that helps you determine the earnings that you simply earned from various sources It's crucial to note there are many different types of taxpayers who might be needed to finish a form of this character7/3/21 tax form 1099 25 Pack Designed for QuickBooks and Accounting Software Professional WO A1 Automated tax return with universal data New Print 1099 Misc forms Free Unique Printable 1099 Tax form 19 EDWARDSFRANKLandCAROLJ 17 Pages 1 50 Flip PDF Download 19 1099 Form Independent Contractor 16 Pdf Free, Fast Answers About 1099 Forms for Independent Workers in Picture Turbotax Form 1099

1099 Nec Forms 5 Part 25 Pack Laser Tax Forms Kit And Self Seal Envelopes Great For Quickbooks And Accounting Software Pack Of Federal State Copys 1099 Nec 1096s Office Supplies Forms Recordkeeping Money

What Is A 1099 Form H R Block

Printable 1099 Form – If you have done any freelance function or other independent contractor function, you might get a 1099 Form from companies that you simply have worked with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid for you previously year being an independent contractor

1099 Form Independent Contractor Pdf How To Report And Pay Taxes On 1099 Nec Income

See Redd Com

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

1099 Form Irs 18

Free California Independent Contractor Agreement Word Pdf Eforms

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Pnc Bank 1099 Int Form 1099 Form 21 Printable

What Is Irs Form W 3

W 9 Form 21 To Print W9 Tax Form 21

Instant W2 Form Generator Create W2 Easily Form Pros

1099 Extension Deadline 21 Fill Online Printable Fillable Blank Form 09 Com

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

How To Fill Out Irs Form W 9 21 Pdf Expert

What You Need To Know About 1096 Forms

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Misc Form Fillable Printable Download Free Instructions

Browse Our Sample Of Independent Contractor Expense Report Template For Free Invoice Template Printable Invoice Invoice Sample

Tax Deductions For Independent Contractors Kiplinger

1099 Nec Form 21 1099 Forms Zrivo

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

1099 Form 19 Pdf Fillable

Form 1099 Nec Instructions And Tax Reporting Guide

Learn How To Fill The Form 1096 Annual Summary And Transmittal Of U S Information Return Youtube

1099 Nec Form 21 Get Irs Form 1099 Nec Instructions 1099 Misc Vs 1099 Nec Difference Printable Sample

Irs Form 1096 Fill Out Printable Pdf Forms Online

W2 Form W2 Form Online W2 Tax Form Printable W2 Form Online

Tax 1099 Form 19 1099 Form 21 Printable

Form W 9 Wikipedia

W9 Blank Form Calendar Template Printable Throughout Free Printable 21 W 9 Form In 21 Tax Forms Calendar Template Personal Calendar

3

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Online Work On Yourself

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

1099 Form Define

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Form Irs 18

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

Www Idmsinc Com Pdf 1099 Nec Pdf

1099 Misc Form Fillable Printable Download Free Instructions

1099 Employee Form Printable 21 1099 Forms Zrivo

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Nec Forms 5 Part 25 Pack Laser Tax Forms Kit And Self Seal Envelopes Great For Quickbooks And Accounting Software Pack Of Federal State Copys 1099 Nec 1096s Office Supplies Forms Recordkeeping Money

Guide To Filing Taxes As An Independent Contractor Divvy

Form 1099 Nec Form Pros

Learn More About 1099 Misc Regarding Business Expenses For Independent Contractors At Nathan Gibson S Business Expense Independent Contractor Best Tax Software

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

Filling Irs Form W 9 Editable Printable Blank Fill Out Or Print Irs Blank For Free

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

Uber 19 1099 Form 1099 Form 21 Printable

Irs Instruction 1099 Misc Fill And Sign Printable Template Online Us Legal Forms

Form 1042 Wikipedia

1099 Misc Form Fillable Printable Download Free Instructions

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

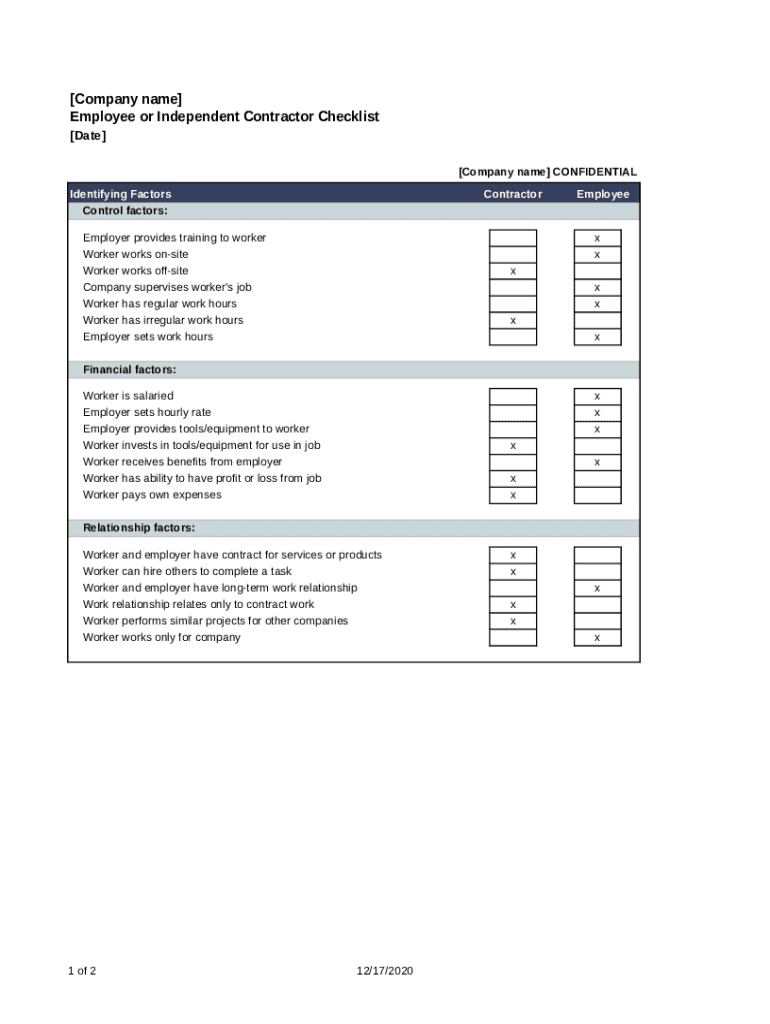

3 Documents You Need When Hiring A Contract Worker

Tax Form 1099 Misc Free 1099 Form Filing 1099 R By Form1099 Issuu

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

1

Independent Contractor Chcklst Fill And Sign Printable Template Online Us Legal Forms

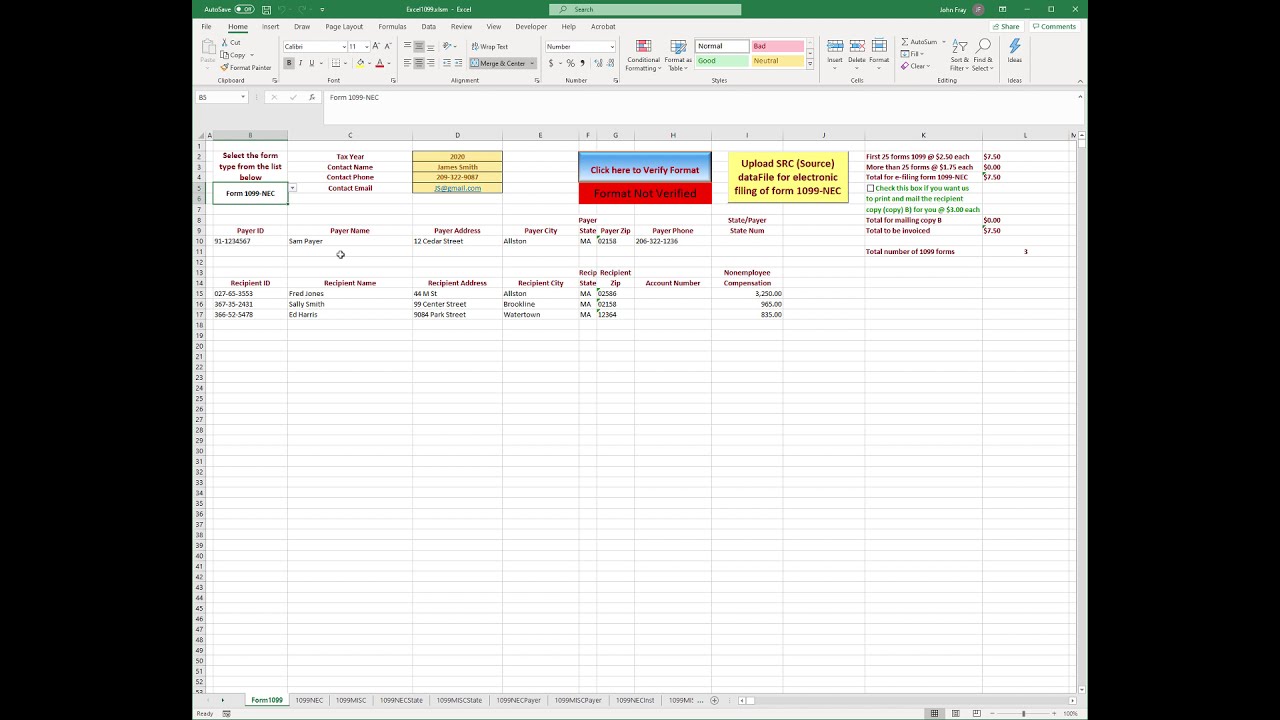

Excel1099 How To File Form 1099 Nec With Excel Youtube

Free Blank 1099 Form 1099 Form 21 Printable

1 0 9 9 N E C F O R M S Zonealarm Results

Downloadable W 9 Forms Printable W9 In Passport In Printable 21 W 9 Form In 21 Calendar Template Irs Forms Personal Calendar

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Irs 1099 K 21 Fill And Sign Printable Template Online Us Legal Forms

Tax Forms Taxgirl

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Forms 5 Part 25 Pack Laser Tax Forms Kit And Self Seal Envelopes Great For Quickbooks And Accounting Software Pack Of Federal State Copys 1099 Nec 1096s Office Supplies Forms Recordkeeping Money

1

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

1 0 9 9 N E C F O R M S Zonealarm Results

1099 Misc Form Copy B Recipient Zbp Forms

Form Ssa 1099 19 1099 Form 21 Printable

/income-tax-4097292_19202-c7df4786d710403295e2e869e5836c78.jpg)

Form 1099 Misc Miscellaneous Income Definition

W2 Form 21 Download Sample In Pdf

21 W9 Forms Printable W9 Tax Form 21

Form 1099 Div Box 7d 1099 Form 21 Printable

1099 Nec Efile 1099 1099 Nec Form By Form1099 Issuu

Free 1099 Misc Online Filing How To E File A 1099 Form On Form1099online By Form1099 Issuu

0 件のコメント:

コメントを投稿